Order Management

Order Management

Updated on June 29th, 2023

-

Order Management

- Dashboard

-

Orders

- Amazon FBA: Common Errors and Troubleshooting

- Orderbot: Split Order by Available Stock

- DHL eCommerce Integration Specifics

- Shipping Orders - Processing Options

- Bulk Actions for Orders

- Custom Fields for Orders (Custom Columns)

- UPS Electronic Customs Documents - ETD & Commercial Invoices

- Multi-Channel Fulfillment

- Duplicate or Clone an Order

- FBA Workflow Box Contents & Secondary "Ship From" Address

- Box Contents Defaults for FBA Workflows

- Customizing the organization of Columns in the Orders Module

- Missing Stock Location and Configuring Inventory

- Downloading and Printing Pick Lists

- FBA Order Management

- Resolving an Order in Missing Product Information Status

- Restoring a Cancelled Order

- Reprinting Shipping Labels

- FBA Workflow

- Importing External Shipments

- Stock Transfers

- Canceling an Order

- Restore an On-Hold Order

- Shipping an Order with Multiple Packages

- Creating and Receiving an RMA

- Creating a Manual Order

- Resolving Out of Stock Orders

- Downloading and Printing Packing Slips

- Creating a Manual Order - Individually or In Bulk

- Manually Mark an Order as Shipped - Individually or in Bulk

- Can I create an RMA for an FBA order?

- Export an Order to a 3PL

- Resolving an order that is "Missing Fulfillment Source"

- Ship Multiple-Package Orders

- Fulfilling an order using MCF (Multi-Channel Fulfillment) for a Core Product in a Bundle

- Validating Shipping Addresses

- Updating Orders in Bulk

- Unresolved: Missing Order Info

- Changing Fulfillment Method and Source

- Importing Orders Via Spreadsheet (In Bulk)

- Resolving an Awaiting Payment Order

- Importing Tracking Information for Shipped Orders via a Spreadsheet

- Changing an Order to Amazon Multi-Channel Fulfillment (MCF)

- Customs

- Shipping Orders

- Merging Orders in Order Manager

- Splitting Orders in Order Manager

- Exporting Orders

- Searching and Filtering Orders

- Extensiv Order Manager Workflow for Sending Dropship Orders via Email

- Resolving Missing Product Info Orders

- How to add an item to an existing order

- Unresolved: Missing Fulfillment Source

- What does the error "Weight cannot be less than the total customs item weight" mean?

- Update about Accessing Orders

-

Inventory

- Viewing Stock Edit History

- Strict FIFO

- Bulk Inventory Reconciliation

- Stock Location - Inventory Management Functionality

- Stock Edit History Export

- Inventory - Transfers Tab

- Inventory - How Extensiv Order Manager Presents Bundle Inventory

- Inventory Update Triggers

- Exporting Stock Details

- Exporting Inventory

- Importing Reorder Rules

- Inventory Rules - Edit History

- Inventory Rules per Master SKU

- Uploading Auto-Reorder Rules in Bulk

- Excluding Warehouse's Stock at the SKU Level

- Channel Allocation Rules in Bulk (Global)

- Creating Auto-Reorder Rules

- Channel Allocation Rules

- How to Search for SKUs in the Inventory Module

- Uploading Inventory via Spreadsheet

- Manually Transferring Stock to Another Location

- Inventory Module Overview

- Inventory Value Reconciliation

- Excluding a Warehouse from Showing Stock for all Products in Bulk

- Importing Stock Minimums

- Incoming Units per Master SKU

- Importing Inventory

- Uploading Inventory Through the UI

- Adding Inventory to a Stock Location Manually

- How to Filter Inventory by Warehouse

-

Purchase Orders

- Available Actions for a PO

- Restoring a PO

- Updating PO Number Prefix

- Re-Sending a PO

- Receiving a P.O.

- Printing a P.O.

- Canceling a P.O.

- Authorizing a P.O.

- Working with PO Milestones

- Voiding a P.O.

- Searching for POs

- Auto POs + Reorder Rules

- How to Create a Manual PO

- How to Automate Purchase Orders (Auto-POs)

- How can I delete a line item from a purchase order?

- Paste from CSV - PO Import

- Understanding Purchase Order (PO) Statuses

- Exporting POs

-

Shipments

- Searching for Shipments

- Printing Shipping Labels

- Printing End of Day Forms

- Tracking Shipments

- RMA Exports

- How do I print an End of Day form or Package Level Detail report for UPS shipments?

- Shipments - Resending Confirmation Emails

- Voiding Shipments

- Postal Zones

- Exporting Shipments

- Parcel API Launch for Extensiv Brands

- Customers

-

Products

- Instructional Video - Master Product Spreadsheet

- Exporting Products

- Product Creation FAQ

- Associating a Listing SKU to a Master SKU

- Creating Core Products in the App

- How to Manage Products

- How to Import Your Vendor Products

- Search For Products

- How to Reassign a Listing SKU to Another Product

- Creating Products through the UI

- Creating Listing SKUs in Bulk (via Spreadsheet)

- Creating Vendor Products in Bulk (Via Spreadsheet)

- How to Disable Inventory Updates for a Specific Sales Channel

- How to Enable Extensiv Order Manager to Automatically Calculate Order Weight Based on Product Weight

- How does Extensiv Order Manager handle variations of the same product?

- Adjusting Master SKUs

- Creating Vendor Products Through the UI

- Creating Product Variations Through the UI

- Creating Products via Spreadsheet

- Creating Listing SKUs through the UI

- Creating Bundles/Kits Through the UI

- Custom Bundle/Kit Export

- Custom Product Fields

- Analytics

-

Settings

-

General

- Tax Identifiers

- Company Time Zone Setting

- Ruby Has 3PL Integration

- Disable the Inventory Update From Extensiv Order Manager to All Sales Channels

- Update My Profile

- How to Enable Out of Stock Control for eBay Sales Channels

- Company Info and Additional Account Settings

- How to View Your Extensiv Order Manager Invoices

- Installing an App from the Order Manager App Store

- How To Remove an App in Order Manager

- Configuring Shipping Presets

-

Sales Channels

- Walmart Fulfillment Services - WFS

- Setting Up Shipment & Carrier Mappings for Your Sales Channels

- WFS Workflow

- Amazon Cancellation Settings

- Amazon Pacific Time Orderbot Setting

- Shopify Locations

- Shopify Tags

- Enable or Disable Extensiv Order Manager Email Notifications to Your Customers

- Deactivating a Sales Channel

- Adding Shopify as a Sales Channel

- Viewing a Sales Edit Channel's History

- Adding Amazon as a Sales Channel

- Adding eBay as a Sales Channel

- Adding Newegg as a Sales Channel

- Steps in Adding Walmart as a Sales Channel

- Editing Sales Channels

- Adding a Manual Sales Channel

- How to Exclude a Warehouse From Pushing Inventory to a Sales Channel

- Assigning a Packing Slip and/or Email Template to your Sales Channel

- Adding Sales Channels

- Reactivating Sales Channels

-

Webhooks

- Order Payment Webhook

- Shopify Auto-Subscribing Webhooks

- Shopify Product Update / Product Edit Webhook

- Shopify Refund Webhook (e-commerce Orders)

- Order Creation Webhook

- Shopify Cancellation Webhook

- Shopify Fulfillment Webhook

- Shopify Refund Webhook - POS Orders

- Shopify Product Deletion Webhook

- BigCommerce Webhook

-

Shipping Providers

- Adding Shipping Providers

- Adding DHL eCommerce as a Shipping Provider

- How to Add Express 1 as a Shipping Provider

- Adding Amazon Buy Shipping as a Shipping Provider

- UPS Mail Innovations Services

- Customizing Shipping Services and Package Types Per Shipping Provider

- FedEx ETD

- Deactivate or Reactivate a Shipping Provider

- Adding FedEx as a Shipping Provider

- Vendors

-

Warehouses & Vendors

- Instructional Video - Creating Warehouses & Warehouse Settings

- Use Component Inventory Setting for Bundles and Kits

- Setting a Dropship Template and Fulfilling Orders with a P.O.

- Configuring Dropship Vendor FTP

- Configuring Shipping Label Print Format Options

- Can I have additional order information populated on my Shipping label?

- Configuring a Dropship Vendor

- How to Configure the Order Export File for FTP Connections

- Search for Vendors

- Inventory Dependent Warehouses

- Updating the Address/Return Address for Your Warehouse

- Deactivating a Warehouse in Extensiv Order Management

- Creating and Configuring Warehouses in Extensiv Order Manager

- Pick List Settings

- Setting Up Document Print Settings

- Setting Up Domestic Backup Warehouses

- FTP Inventory Import for a 3PL

- Setting Up a Warehouse's International Rank

- How do I connect Extensiv Order Manager with Deliver?

- Setting Up a 3PL Warehouse

- Creating an In-House Warehouse

-

Orderbots

- Adding Order Item to Order Orderbot Action

- Understanding Apply Best Rate vs Cheapest Rate Orderbots

- Commonly Used Orderbots

- Support for Shopify's Additional Details

- Orderbots filtered by zip code range

- Postal Zones in Extensiv Order Manager

- Mark Order as Shipped Orderbot

- Automating Orders to Fulfill from a Specific Warehouse

- Editing an Orderbot

- Deactivating an Orderbot in Extensiv Order Manager

- Replace Address Orderbot

- Creating an Orderbot

- Orderbots - Complete List of Filters & Actions

- Orderbot: Set order weight and dimensions based on products

- Orderbot: Using Hold the order for and Mark Order as Shipped

- Templates

-

General

- API

- API Integrations

- Accessing and Navigating Order Manager

- Error Messages

-

Order Manager

- Customer Experience Upgrades

- Brexit for UK Inventory & Shipments

- BigCommerce Order Statuses

- Order Export Configuration in the UI- Complete List of Order Export Fields

- FBA to FBM Conversions - Amazon North America Remote Fulfillment with FBA Sellers

- Error Message “Invalid Customs Item Data”

- Integrating Endicia

- Error: "The Shippers shipper number cannot be used for the shipment"

- Edit Shopify Order Items

- Adding BigCommerce as a Sales Channel

- Where does Extensiv Order Manager determine Inventory Value and COGS from?

- Endicia's pay-on-use return labels?

- [FAQ] What other Amazon marketplaces do you integrate with?

- Does Order Manager Support Amazon Buy Shipping?

- Shopify POS Location Capture and Orderbot

- Formatting Order Information When Shipping to US Territories

- Enable Shopify POS

- Reactivating an Orderbot

- Setting Up Billing/Inventory Allocation Zones

- How To Set Up Shipments Import

- What are Orderbots?

- Addressing missing Snapshot Data on July 9, 2023

-

Popular Articles

- Viewing Stock Edit History

- Error: "The Shippers shipper number cannot be used for the shipment"

- Support for Shopify's Additional Details

- How to Manage Products

- Walmart Fulfillment Services - WFS

- Does Order Manager Support Amazon Buy Shipping?

- What are Orderbots?

- Understanding the Extensiv Order Manager Dashboard

- Amazon FBA: Common Errors and Troubleshooting

- Shopify Refund Webhook - POS Orders

- Accounting Integrations

Where does Extensiv Order Manager determine Inventory Value and COGS from?

The term "Inventory Value" refers to the dollar amount that each unit of a Master SKU is worth. Inventory Value is recorded as the Cost of Goods Sold (COGS) once the order has been shipped.

Inventory Value for each unit comes from one of two places:

- Actual IV Entries - These entries exist in the IV FIFO Queue. These are entries Order Manager has officially created from one of the following methods: Receiving units via Purchase Order or using the Reconciliation feature. You can find the history of these actual entries by clicking the Inventory Value History button under Stock Details on a warehouse basis.

- Default IV - The assigned value Order Manager gives to your units that have no Actual IV Entry (aka when there is a "Discrepancy"). Default IV is used for Analytics purposes and for the COGS amount recorded upon shipment.

- First In, First Out (FIFO) Landed Cost value for units received via a Purchase Order which creates Actual IV Entries.

NOTE

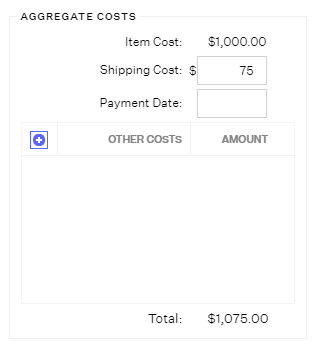

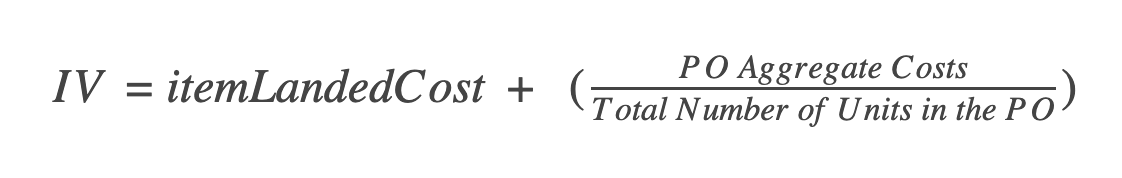

The Landed Cost used for Inventory Value will incorporate any Aggregate Costs for the PO divided amongst the Total Units Ordered. Aggregate Costs do not include the automatically shown "Item Cost" amount, only any additional costs added. So in the example below, the total "PO Aggregate Costs" would be $75. The Purchase Order amount is $1,075.00.

Additionally, this same amount will be used to calculate Default IV for any same-SKU units with a Discrepancy as long as there are any remaining units received from the PO unshipped in the IV FIFO Queue.NOTE

Aggregate Costs for a PO (found in the Details tab of a PO) are automatically factored into the final Inventory Value for stock when it is received via PO. The Aggregate Costs for a purchase order do NOT include Discounts. If you want the Inventory Value FIFO Queue to reflect any applicable discount, then that discount needs to be manually included in the final cost for each line item. That means you will need to physically edit the Landed Cost field for every line item that has a discount on a PO from its current value to one that incorporates the price of the line item with the Discount applied. If you do not physically edit the Landed Cost value for a line item, then it will simply be calculated using the default calculation.

Example: You received 10 units of a SKU via PO at an IV for $1 each even though the Default Vendor Product Cost is $2. You manually added 100 units of the same SKU directly via the Inventory Module and you didn't Reconcile them. You now have 10 units with an Actual IV entry of $1, and 100 units with a Default IV of $1 each, bringing your Total IV for that SKU to $110. As long as any of the 10 units received via PO are unshipped and you have un-reconciled units, your 100 units will be valued at $1. But as soon as the last of your 10 units received via PO are shipped, Default IV will start pulling from the Default Vendor Product Cost (covered below), so your 100 un-reconciled units would then be valued at $2 each, with a Total IV of $200.

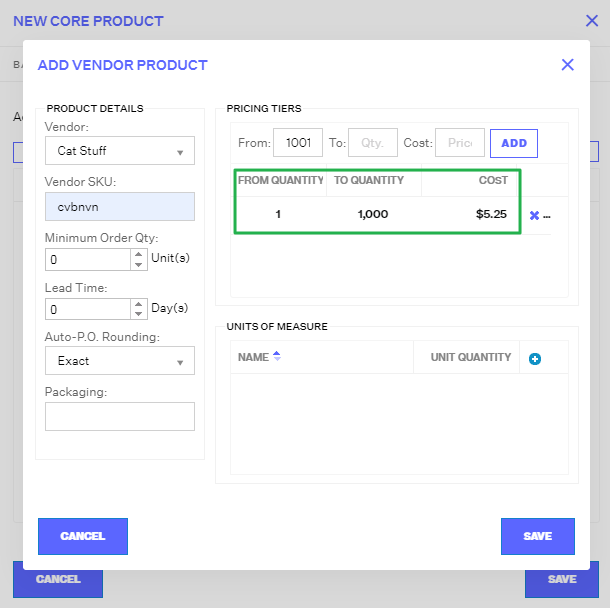

- The Default Vendor Product's "Cost" can be found in the Vendor Product. Order Manager will use the top line quantity to calculate Inventory Value.

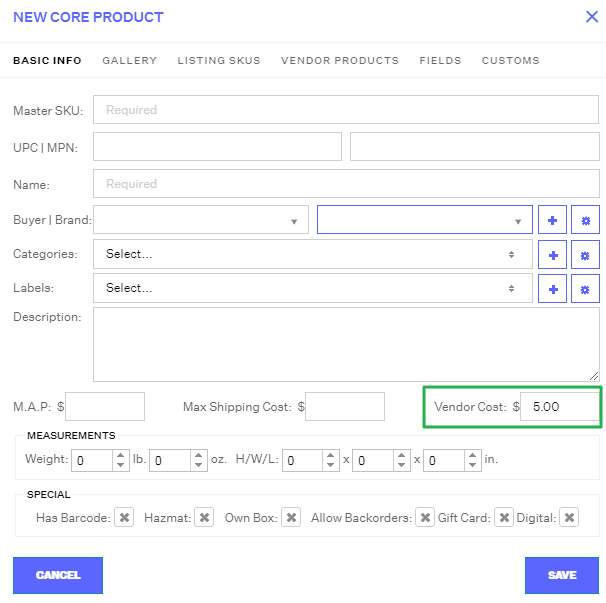

- If there is no cost associated with the Vendor Product, Order Manager looks for Vendor Cost in the product.

- If Order Manager cannot find any of the above for the product, IV and COGS will be shown as $0.

For instructions on how you can edit your IV queue, see this article on the Inventory Reconciliation feature.